New bankruptcy law reform

1. New bankruptcy law reform

On September 26 the new bankruptcy law reform.

bankruptcy law regulates the insolvency system of a country.

Its objective is to establish and define the steps that must be followed by companies with a large accumulation of debts and without the capacity to settle them.

Fundamentally, it defines how to carry out the so-called bankruptcy processes, which articulate how to liquidate a company in the event of final insolvency.

For this reason, we want to familiarize you with it and clarify what are the main new features that it incorporates.

2. On what subject have the changes in the Spanish bankruptcy law been focused?

The last bankruptcy reform, search solve the main limitations of the system insolvency Spanish.

Already in its Preamble, it specifies which are the main blocks worked on:

– Pre-bankruptcy instruments.

– Late appeal to the contest.

– Excessive prolongation of contests. It also notes and warns that 90% of cases end in liquidation, not in an agreement.

– Missing the second chance.

In the presentation text, the legislators confess their willingness to overcome these limitations with a profound structural reform of the insolvency system.

As you well know, excess debt It can lead to a situation of economic unsustainability for your company. To counteract this reality, you can only try to solve the problem or liquidate the company, that is, give up.

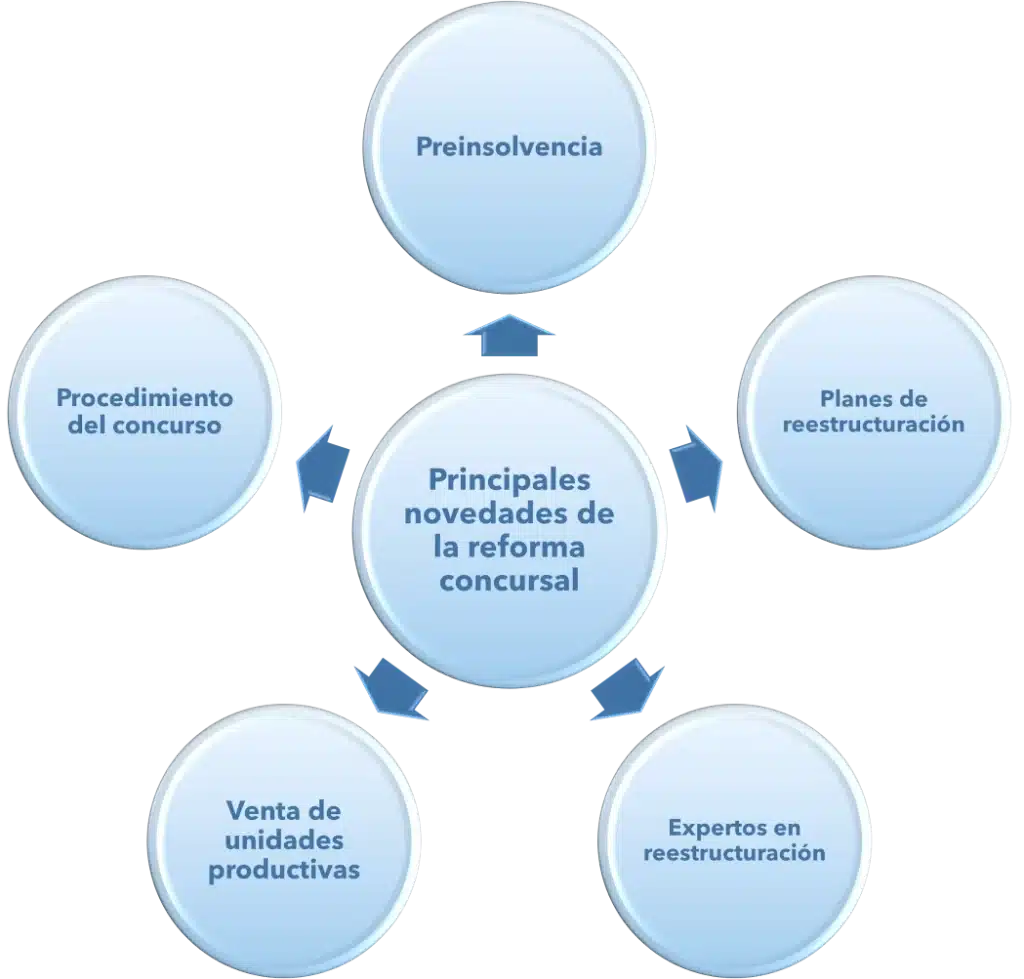

3. Main novelties of the bankruptcy reform

Next, we analyze which are the most significant modifications that affect, after this modification, the Spanish bankruptcy law.

3.1. pre-insolvency

In the first place, new formulas and opportunities are materialized to restructure the debt.

In this sense, creditors also benefit, since pre-bankruptcy instruments are materialized that provide greater agility, breadth and versatility.

For example, the drag of all kinds of creditors, including the partners of the company in debt.

3.2. restructuring plans

Furthermore, the bankruptcy reform It intends to anticipate the work to clean up companies at risk of insolvency.

It acts, before that debt with guarantee or not, earlier.

The objective is to increase the possibilities of economic regeneration.

Society loses less value and, in addition, commercial courts reduce their workload -thus speeding up processes-.

3.3. Restructuring experts

In the same direction, this figure recently incorporated into the Concursal lawComplete the previous section.

Its function is to assist the debtor and its creditors in the initial meetings, in order to find a satisfactory solution for all.

3.4. Sale of production units

Fourthly, the so-called prepack.

The judge in charge of the contest appoints an expert and entrusts him with the mission of gathering potential purchase offers for the available production units.

The completion of these transactions alleviates, even partially, the situation of the debtor company.

This possibility of anticipating the preparatory acts of transmission is inspired by the solutions applied in the Netherlands or the United Kingdom.

3.5. Contest procedure

Por último, la bankruptcy reform it modifies some important processes.

Thus, for example, it establishes the elimination of the anticipated agreement proposal.

Additionally, it recognizes in the final phase of the liquidation the subordination agreements that are not detrimental.

4. How can Microenterprises access a bankruptcy process?

The truth is that a special procedure is established for this category, although different requirements must be met, such as the following:

– Have had a average less than ten workers during the year prior to the application.

– Have a annual turnover of less than 700 euros or, failing that, with a liabilities less than 350 euros.

To verify these last two data, the last closed accounts of the year prior to submitting the application will be used.

5. How can you access credits from the Official Credit Institute?

In parallel, the refinancing procedure of debt with guarantee through the Official Credit Institute, commonly known as ICO.

6. A final summary of the bankruptcy reform

To conclude, let us briefly summarize how these legal innovations will change the Spanish insolvency system in three great senses:

1. Better and faster access to preventive restructuring frameworks for companies that, being viable, have difficulties of debt.

2. Increase in efficiency of bankruptcy proceedings.

3. Access to a second opportunity for bona fide individuals who are insolvent or over-indebted.

At this point, you already have more clear how is the new bankruptcy law. Hopefully everything goes well in your company and you should never resort to it.

How can we help you from WorkCapital?

As you know, WorkCapital It is a benchmark in the alternative financing sector.

Thanks to our services invoice advance y promissory note discount, we have positioned ourselves as one of the best alternatives to improve your treasury and solvency situation in the short term.

Whether you are -or not- in a bankruptcy process, do not hesitate to contact us if you need immediate liquidity.