What is cash flow and how does it influence the viability of a company?

1. The cash flow to manage a company

El cash flow It is one of those Anglo-Saxon terms that is essential to know when managing a business.

Not surprisingly, it is a basic concept in the economy and accounting analysis of any business organization.

To empower and safeguard the viability of your companyYou must continually train.

In this context, the cash flow plays a fundamental role in the economic development and financing of any company.

2. What is the cashflow?

This word is part of the usual vocabulary of any accountant or economic director of a company.

If you are self-employed and you are aware of the viability of your project, it will not take you long to find it on your way.

Cash flow refers to cash flow or treasury and is characterized by:

– Be an indicator of the company liquidity.

– Contemplate the input and output flows of cash.

– Focus on a specific period of time.

Therefore, it reflects the capacity of your business to generate liquidity and meet the payments that arrive.

This basic information is key to deciding if it is necessary to resort to the financing for companies.

Believe it or not, knowing this information is crucial to analyzing the viability of a company.

In this sense, it can happen that a company with good results does not have liquidity to face its immediate payments and, consequently, it could be condemned to bankruptcy if it does not find a suitable financing method for its needs.

3. What types of Cash Flow are there?

You should distinguish these three types of cash flow:

– Exploitation. It focuses on ordinary income, that is, that derived from the specific activity of your business. Specifically, the provision of services or the sale of products.

– Investment. It contemplates the cash flows from the real estate or financial investments of the organization.

Financing. Applies to activities financing for companies that modify their own capital and accumulated debts.

4. What is the formula of cash flow?

Within the period in which you are analyzing the company viability, you need to add these economic elements:

- Net profit.

- Amortization.

– Provisions.

Keep in mind that the amount obtained may not match the result of the business.

Imagine, for example, that you have several large customer defaults. In theory, accounting, you can be showing great results. However, cash flow could be on its last legs and yet financing for companies, you will be lost.

Therefore, we recommend that you do not stop calculating it periodically to verify the correct functioning of your project.

This indicator is perfect to reassure and reinforce your good work or, failing that, to know that corrective measures must be taken.

Now,

What should you do if your cash flow throws up red flags?

5. Good practices to improve the Cash flow

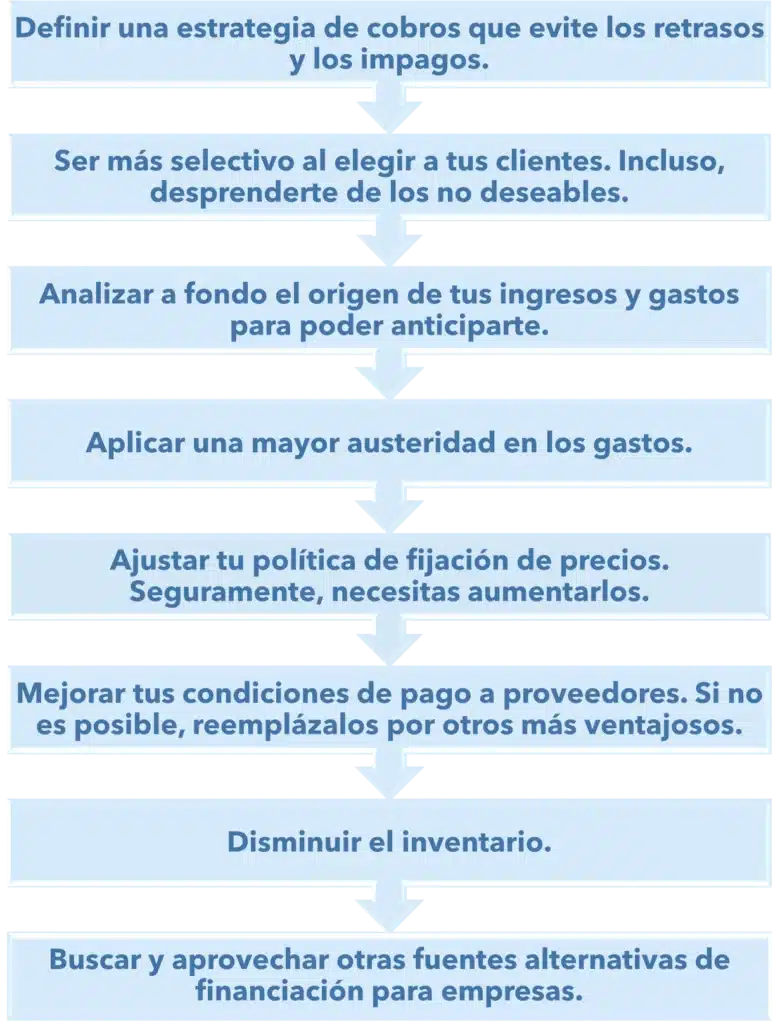

In essence, negative cash flow indicates a mismatch between economic availability and immediate payments what is there to do. If you are in this situation, we recommend you implement the following measures:

1. Define a collection strategy to avoid delays and defaults.

2. Be more selective when choosing your clients. Even get rid of the undesirables.

3. Analyze thoroughly the origin of your income and expenses to be able to anticipate.

4. Apply a greater austerity in expenses.

5. Adjust your policy price fixing. Surely, you need to increase them.

6. Improve your conditions of payment to suppliers. If this is not possible, replace them with more advantageous ones.

7. Decrease the Inventory.

8. Find and take advantage of other alternative sources of financing Enterprise.

6. Three good financing options for companies that improve the Cash flow

Have you ever resorted to promissory note discounts, the confirming and the advance invoice?

Its use has a direct effect on improving cash flow.

Basically, these tools allow you to advance the time of collection of your rights. In this way, you have liquidity on time and can meet your payment obligations.

We proceed to briefly explain the instruments discussed above:

– Discount of promissory notes. An intermediary company discounts that collection right before expiration in exchange for a commission.

–Confirming. Your supplier hires a financial institution to pay your invoices to suppliers in advance, in exchange for a small percentage.

– Advance invoices. The financial company pays you the entire invoice, except for a small commission, before its expiration.

Is it clear to you what is cash flow and how does it affect your business?

Remember that the alternative financing It can be a good ally in the fight for the liquidity of your project.

At WorkCapital, we adapt our financial products to the needs of your business.

Get in touch with us and ask us without obligation!